Simplifying the Difference Between Original Medicare and Medicare Advantage Plans

People from all walks of life deal with illnesses and injuries but getting proper treatment can be financially challenging, particularly for senior members of our community. Original Medicare is a federal program that helps the elderly and disabled afford care. As part of our commitment to serving at-risk New Yorkers, MJHS wants to make sure our neighbors know how to access the benefits available to them through Original Medicare.

Original Medicare is a nationwide health insurance program that provides health care coverage (health insurance) for individuals who are:

- 65 or older and eligible for Social Security

- Under 65 and have received Social Security Disability benefits for 24 months before enrolling

- Diagnosed with End Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS, also known as Lou Gehrig’s disease).

If you or your loved one fall under one of the criteria above, you should consider enrolling in Original Medicare, which can help you pay for a portion of your health care expenses.

Since understanding the program can be a little complicated, we’ve broken down the basics for you.

How does Original Medicare Work?

Health care can involve many types of expenses–tests, surgical procedures, hospital stays, in-home care, specialist fees, preventative services, medications—but since we all have different health needs, not everyone needs all of these expenses covered to the same degree. For this reason, the coverage provided by Original Medicare is broken into parts, and each part includes coverage for different kinds of care.

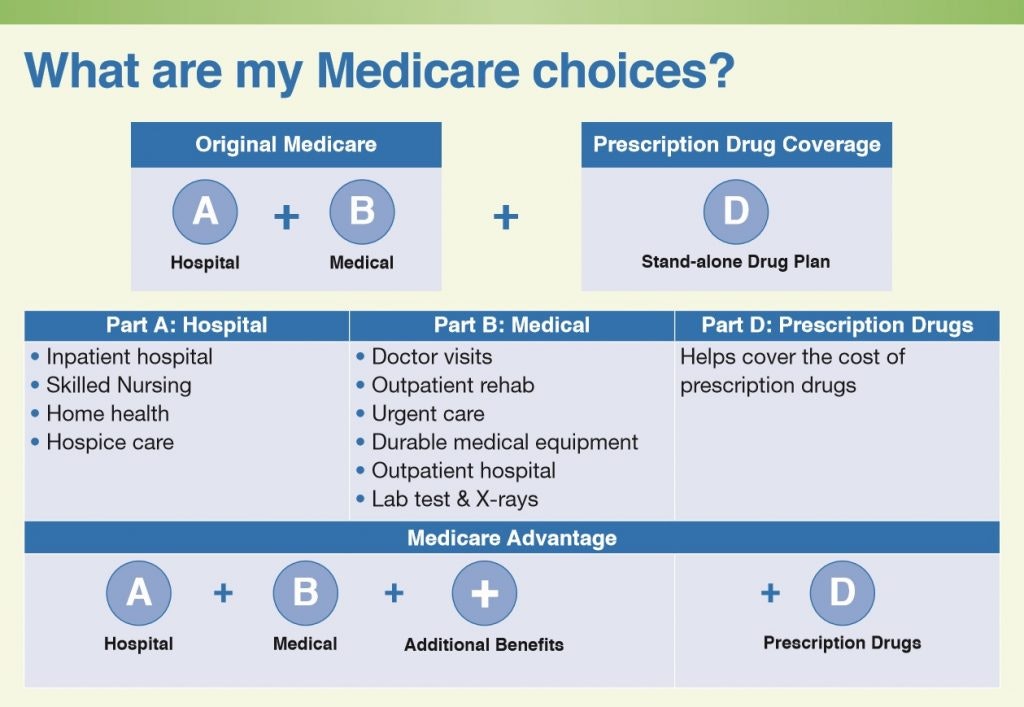

This chart explains the differences between the different parts of Original Medicare:

Original Medicare includes Part A Hospital coverage (usually with no premium), Part B Medical coverage (which requires a premium) and optional Part D Prescription Drug coverage. Your premiums will depend on your income level. For the 2020 prices of Original Medicare part B and D premiums, see this list of 2020 Original Medicare Costs.

Data Source: Elderplan

It is best to start the process of applying for Original Medicare three months before your 65th birthday to avoid a gap in coverage, which can result in a late enrollment penalty (LEP). You may apply for Original Medicare by visiting your local Social Security Office or the Social Security government website. Original Medicare is great, but it is important to note that it only covers about 80% of your out of pocket expenses, there is no annual cap on what you may pay out-of-pocket, and there are services that are not covered at all. Medicare Advantage plans were created to cover some of what Original Medicare does not.

What is Medicare Advantage?

A Medicare Advantage plan, sometimes referred to as Part C, offers an alternative to Original Medicare. Medicare Advantage gives people more plan options to choose from, and they offer the efficiency and cost-savings that tend to be associated with programs managed by the private sector.

When you enroll in a Medicare Advantage plan, you receive your Part A, Part B and (usually) Part D benefits through a single plan sold by a private insurance company. The Federal government directly pays an insurance company of your choice to administer your benefits for you. You will need to be enrolled in Original Medicare Parts A and B before you are eligible to enroll in Medicare Advantage.

Each Medicare Advantage plan has different service areas, physician and hospital networks, drug lists (formularies), and cost sharing, so if you choose Medicare Advantage, you’ll need to do some shopping to identify which plan best meets your needs. Some Medicare Advantage plans, like Elderplan, are not-for-profit. These plans reinvest their earnings into plan benefits versus paying profits to shareholders.

Should I choose Original Medicare or Medicare Advantage?

Medicare Advantage plans usually have lower out-of-pocket costs and typically offer additional benefits that aren’t covered by Original Medicare, such as prescription drugs, hearing, dental, vision, wellness benefits like a gym membership, Over-the-Counter (OTC) coverage, and transportation. These benefits will vary depending on the plan you choose.

Compared to Original Medicare, Medicare Advantage plans are somewhat more restrictive since you will only be able to see the specific doctors that are covered by your plan. Some plans will also require a referral to see specialists. In addition, the coverage is often restricted to a specific geographical area, except in the case of an emergency.

You might consider Medicare Advantage if you:

- Confirm current physicians are covered by the plan you are considering or you are flexible about your choice of doctor

- Want to avoid deductibles and the 20% cost sharing you are responsible for under traditional Original Medicare

- Live in one location most of the year

- Take a number of prescription drugs

- Have interest in extra benefits (e.g. routine vision/dental/hearing services, membership in fitness programs, etc.)

When comparing Medicare Advantage plans, be sure to explore Elderplan, a member of MJHS Health System. Elderplan is a not-for-profit health plan that has been caring for New Yorkers with compassion, dignity and respect for more than 35 years. Elderplan reinvests its earnings to provide improved benefits and services to Original Medicare- and dual-eligible (Original Medicare + Medicaid) beneficiaries.